accounts receivable insurance coverage example

Acme Plumbing and Drywall suffered. For example if you lost your accounts receivables records this coverage will pay for the cost to replace those records.

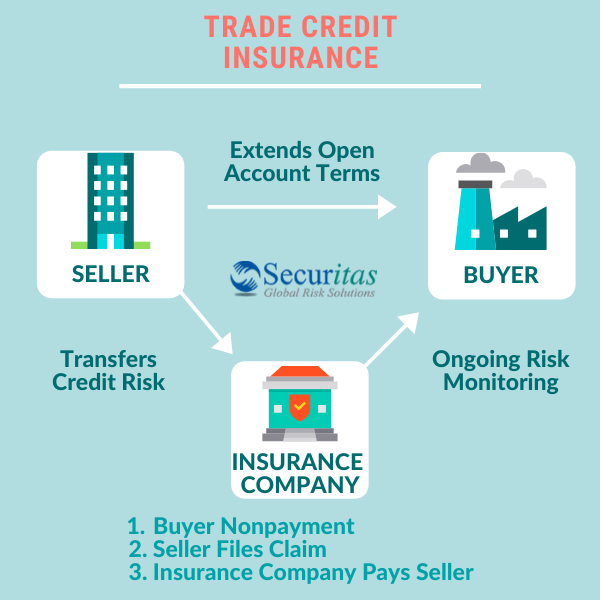

Trade Credit Insurance Securitas Global

A typical accounts receivable insurance policy describes which customers and receivables qualify for coverage typically between 80 to 90 percent based on their perceived.

. There are four key reasons. Even if the matter against you is ruled in your favor the cost of defense can be high and the impact on your reputation can be damaging. AR insurance can help accelerate revenue growth through credit expansion and balance sheet protection More working capital.

THREE Covers It All. EO General Liability Workers Comp Cyber Insurance More. Coverage applicable at the named insureds.

Some items you should know about accounts receivable insurance are. Accounts receivable insurance protects against this type of loss. Definition of Accounts receivable insurance.

Accounts receivable insurance can take the form of multi-buyer. Ad Cover Any Unexpected Losses with Credit Insurance. The ISO advisory form CM DS 03 09 04 lists limits of insurance for different coverage offered by the accounts receivable form.

Get the Peace of Mind You Deserve. Accounts Receivable Insurance features the following. Buy Workers Compensation General Liability Property Liability Umbrella More.

A QUICK GUIDE TO ACCOUNTS RECEIVABLE INSURANCE. Accounts Receivable Insurance. When these records are destroyed or damagedsay in a.

What would one stand to lose if its accounts receivable records no longer existed. EO General Liability Workers Comp Cyber Insurance More. Trade credit insurance also known as accounts receivable insurance or AR insurance is a type of insurance policy that businesses can purchase to cover any financial losses they might.

The Accounts Receivable Coverage Form CM 00 66 01 13 is required if the insured wishes to obtain broader consequential coverage. Ad Cover Any Unexpected Losses with Credit Insurance. Get the Peace of Mind You Deserve.

However one larger customer owing 60000 didnt pay due to bankruptcy wiping out the profitability of the business. One of the best ways to guard against non-payment risk is to purchase accounts receivable insurance. The methodology of calculating losses.

Accounts receivable insurance coverage would protect your business in the event that a customer changes his or her mind. The policy covers these. An accounts receivable insurance policy covers you in the event that your payment records are destroyed or lost.

The insured has some options when deciding on accounts receivable insurance. If the policyholder injures another individual in a car accident this insurance. To enhance the customer experience.

Accounts Receivable Coverage insures against loss of sums owed to the insured by its customers that are uncollectible because of damage by an insured peril to accounts receivable. Accounts receivable insurance is fairly broad coverage if you have a loss. But they are also high riskespecially in the.

Accounts receivable insurance protects against defaults resulting from customer insolvencies business closures ownership changes cash flow problems balance sheet. Ad Accountants Need More Than EO Insurance - Get Full Coverage with One Policy. Thankfully the business had purchased accounts receivable.

Coverage when business records are destroyed by an insured peril and the business cannot collect money owed. Loss of Contracted Work Its important to remember that. Get the Risk Data You Need to Extend Credit to the Right Customers Safely Expand Sales.

Ad Over 75 Years of Insurance Experience -- Trusted by Thousands of Businesses Nationwide. A form of credit insurance offered by commercial insurers to businesses. For instance if an.

Get the Risk Data You Need to Extend Credit to the Right Customers Safely Expand Sales. Every small Accounts Receivable Specialist. As soon as practicable after the Forbearance Effective Date but no later than April 30 2009 the Companies shall obtain and thereafter maintain.

Also known as trade credit. Accounts receivables are a critical component of your balance sheet they directly affect your cash flow and profitability. Ad Accountants Need More Than EO Insurance - Get Full Coverage with One Policy.

Here are some examples of several types of auto insurance coverages. Businesses can also receive substantial losses if key customers do not pay or pay late. In addition to ensuring customer satisfaction developing a good customer experience in accounts receivable helps.

Coverage may be written on either a. From the definition of accounts receivable insurance presented above you know that this tool helps companies protect themselves against non-payment risks and maintain their balance. THREE Covers It All.

/commercial-property.tmb-.png?sfvrsn=8)

Accounts Receivable Coverage Insurance Glossary Definition Irmi Com

Adjusting Entries For Asset Accounts Accountingcoach

/GettyImages-889031464-9968a0ffa17e4da5bef56775ea2f2e46.jpg)

Accounts Receivable Insurance Definition

Get Our Image Of Schedule Of Accounts Receivable Template For Free Statement Template Accounts Receivable Accounting

Accounts Receivable Specialist Resume Examples And Templates That Got Jobs In 2022 Zippia

Best Practice For Managing Insurance Accounts Receivable

Insurance Journal Entry For Different Types Of Insurance

Accounts Receivable Management In Healthcare The Doctor S Complete Guide Mdmanagement Group

How To Reduce Accounts Receivable Ar Days In Healthcare Capminds Blog

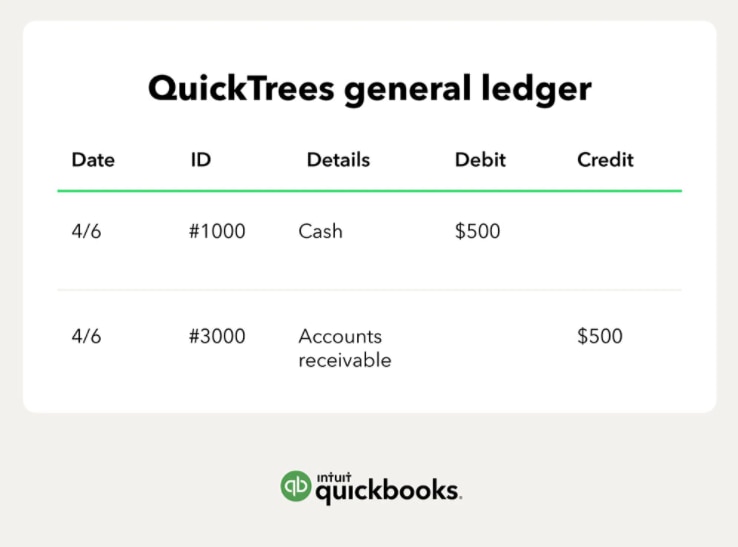

What Is Accounts Receivable Quickbooks Canada

Accounts Receivable Insurance Faq Match An Agent Trusted Choice

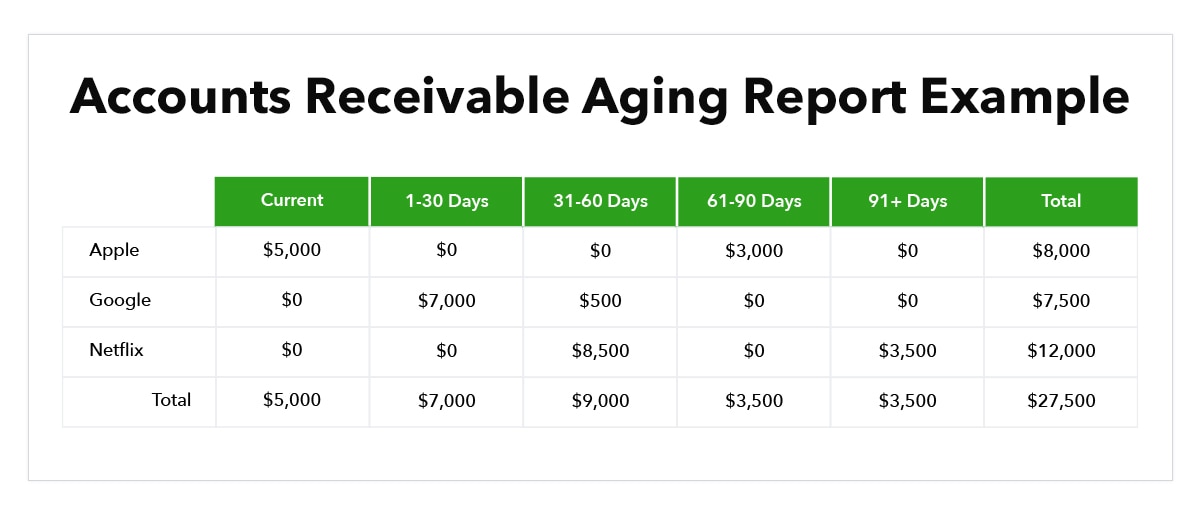

What Is An Accounts Receivable Aging Report And How Do You Use One Article

What Is Accounts Receivable What Kind Of Account Is Accounts Receivable

Accounts Receivable Management In Healthcare The Doctor S Complete Guide Mdmanagement Group

Insurance Journal Entry For Different Types Of Insurance

Accounts Receivable Management In Healthcare The Doctor S Complete Guide Mdmanagement Group

Accounts Receivable Ar Insurance Atradius Usa

Accounts Receivable Management In Healthcare The Doctor S Complete Guide Mdmanagement Group

Comments

Post a Comment